Not known Details About Health Insurance In Dallas Tx

The Best Guide To Commercial Insurance In Dallas Tx

Table of ContentsHome Insurance In Dallas Tx Can Be Fun For EveryoneThe smart Trick of Home Insurance In Dallas Tx That Nobody is Talking AboutThe Facts About Health Insurance In Dallas Tx RevealedGetting The Health Insurance In Dallas Tx To WorkAll About Home Insurance In Dallas TxHealth Insurance In Dallas Tx Fundamentals Explained

The premium is the amount you pay (typically monthly) in exchange for medical insurance. Cost-sharing refers to the section of eligible healthcare costs the insurance provider pays and also the section you pay out-of-pocket. Your out-of-pocket costs might consist of deductibles, coinsurance, copayments and also the complete expense of health care services not covered by the strategy.High-deductible plans cross classifications. Some are PPO strategies while others may be EPO or HMO strategies. This type of health and wellness insurance policy has a high insurance deductible that you need to meet prior to your health and wellness insurance policy protection works. These strategies can be appropriate for individuals that intend to conserve money with reduced month-to-month costs and do not prepare to use their clinical coverage thoroughly.

The drawback to this type of protection is that it does not meet the minimal vital protection needed by the Affordable Treatment Act, so you might additionally go through the tax charge. Furthermore, temporary plans can leave out coverage for pre-existing problems. Short-term insurance is non-renewable, and also does not include insurance coverage for preventative care such as physicals, vaccinations, dental, or vision.

Life Insurance In Dallas Tx Things To Know Before You Buy

Consult your very own tax, accountancy, or lawful advisor rather than relying upon this write-up as tax obligation, audit, or legal guidance.

You can normally "leave out" any kind of house participant that does not drive your auto, but in order to do so, you should submit an "exemption kind" to your insurance provider. Vehicle drivers that just have a Learner's Permit are not required to be listed on your plan till they are completely certified.

The Facts About Commercial Insurance In Dallas Tx Revealed

You require to buy insurance coverage to protect yourself, your household, and also your wide range (Life insurance in Dallas TX). An insurance coverage might conserve you hundreds of dollars in the event of a mishap, ailment, or disaster. As you hit particular life landmarks, some policies, consisting of health and wellness insurance and car insurance coverage, are basically called for, while others like life insurance and disability insurance are strongly encouraged.

Mishaps, ailment and also catastrophes occur at all times. At worst, events like these can dive you into deep financial spoil if you do not have insurance to draw on. Some insurance plan are unavoidable (assume: vehicle insurance in most US states), while others are merely a wise monetary decision (think: life insurance policy).

And also, as your life adjustments (state, you obtain a new job or have a child) so ought to your coverage. Listed below, we've discussed briefly which insurance protection you need to strongly consider purchasing every stage of life. Note visit here that while the plans below are prepared by age, obviously they aren't ready in rock.

The Main Principles Of Commercial Insurance In Dallas Tx

Right here's a short review of the plans you require and also when you require them: The majority of Americans require insurance coverage to pay for health care. Selecting the plan that's right for you may take some research, however it functions as your very first line of defense against clinical financial obligation, among greatest sources of financial debt among redirected here customers in the United States.

In 49 of the 50 US states, motorists are needed to have automobile insurance to cover any type of prospective building damages and also bodily harm that may arise from a mishap. Cars and truck insurance coverage rates are mostly based upon age, credit report, car make and also version, driving document and also area. Some states also consider gender.

The 9-Second Trick For Home Insurance In Dallas Tx

An insurance firm will certainly consider your home's location, as well as the size, age and build of the home to identify your insurance policy premium. Houses in wildfire-, twister- or hurricane-prone areas will often command higher premiums. If you market your residence and also go back to leasing, or make other living arrangements (Health insurance in Dallas TX).

For people that are maturing or disabled and require aid with daily living, whether in a retirement home or via hospice, lasting care insurance can aid bear the inflated expenses. This is the sort of point individuals don't consider till they age as well as understand this may be a reality for them, yet naturally, as you get older you obtain much more expensive to guarantee.

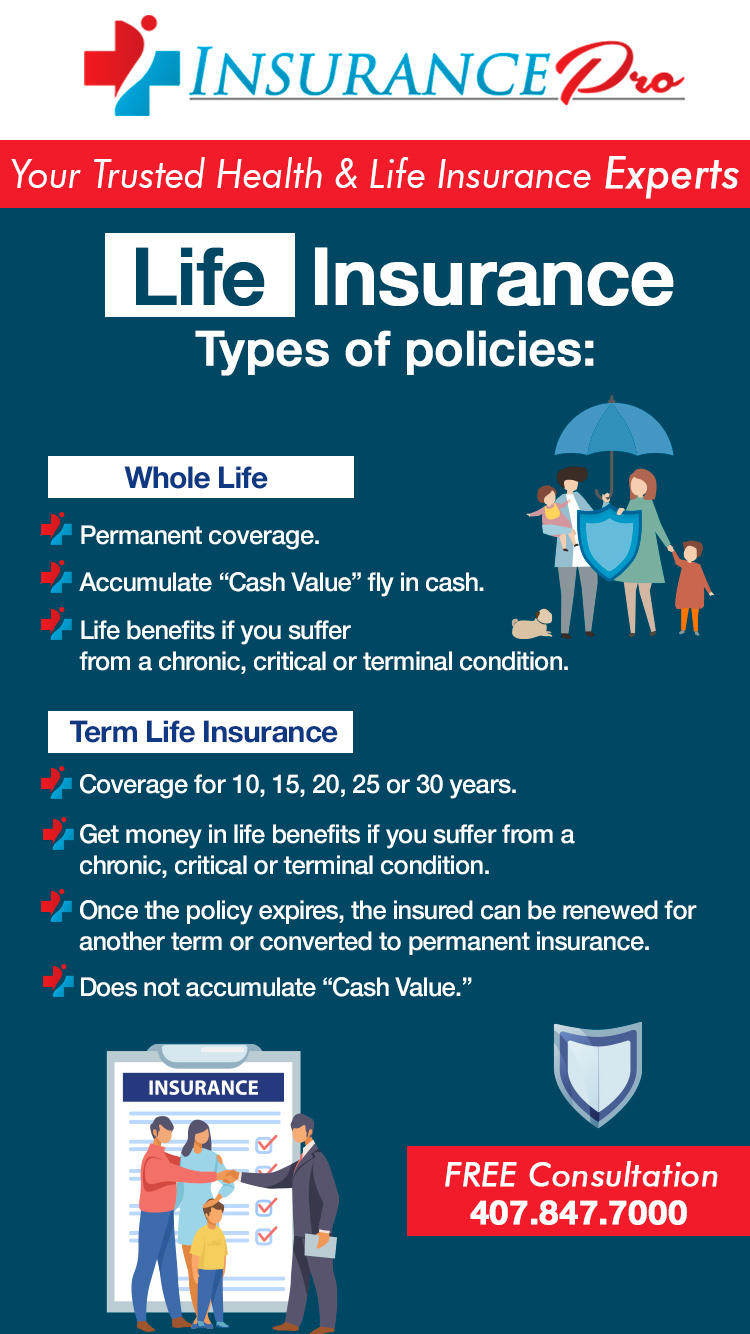

Essentially, there are two sorts click here for more info of life insurance policy prepares - either term or long-term strategies or some combination of the 2. Life insurers use various kinds of term plans and also conventional life plans in addition to "passion sensitive" items which have ended up being more common since the 1980's.

Insurance Agency In Dallas Tx Fundamentals Explained

Term insurance coverage offers security for a given period of time. This period could be as brief as one year or give protection for a details variety of years such as 5, 10, two decades or to a defined age such as 80 or in some situations as much as the oldest age in the life insurance policy mortality.

The longer the warranty, the higher the first premium. If you die during the term duration, the company will certainly pay the face amount of the plan to your beneficiary.